How To Build A Trading App – A Full Guide For 2021

- Ilya Chubanov

- Mar 3, 2021

- 8 min read

Updated: Jun 14, 2024

Tap into one of the most lucrative fintech markets today with a trading app consumers will love.

Trading platforms have taken years to become the popular force they are today. Initially, the financial sector pushed back against these technologies. Now, they generate and move billions of dollars in revenue, capital and cryptocurrency. It’s for these reasons, you might want to create and launch your own trading app. It’s a risky venture, but the payoff can be big.

In this article, Invatechs will give you a full guide for creating your own trading app and platform. Like the popular app Robinhood, we’ll help you build one made for success. We’ll conduct a market overview and look at some key features your app needs. We’ll consider the costs and take a look at some of the most popular platforms. To conclude, we'll cover some FAQs.

Now is the time for you to take action and stake your claim in this expanding market. We’re here to empower you with knowledge. With the help of Invatechs’ fintech solutions, we can help you unleash your potential!

WHY ARE INVESTMENT & TRADING PLATFORMS POPULAR TODAY?

Just how big are trading platforms today? How fast are they evolving, and why? Let’s take Robinhood as an example. Between 2017 to 2020, they grew from 2 million users to 13 million users. Once an exclusive market for investors, it's now a viable option for anyone with a trading app on their phone. In fact, Investopedia discovered a lucrative market of investors in Millennials and Gen-Z.

Everyone, from young entrepreneurs to established investors, is looking for decent trading platforms. The market is growing globally. We can observe growing trends in the technical potential of these apps. These include more customisable features, high-speed operations, and mobile responsiveness with cloud-based technology.

Just take a look at the popular trading app Fidelity. You can trade with them on Apple TV, your Apple Watch, iPad and Kindle Fire. Some large, traditional banks like Bank Of America are even adding trading options to their apps. The technical infrastructure and features of these apps are growing every day. This means your app has to offer something fresh and innovative.

The GameStop incident in January 2021 was one of the biggest events in recent trading history. On the one hand, it has decreased entry-level in stock market investing. However, it has also opened the door for a new generation of investors looking for trading apps.

WHAT ARE THE TYPES OF TRADING SOFTWARE?

So we’ve identified an exciting new potential in stock trading. However, it’s important to know about the types of software you can work with. Trading software serves users with multiple services. They include: facilitating the trade of stocks, currencies (fiat and cryptocurrencies), future markets and options.

Trading software come with a variety of solutions you’ll want to consider when building your app. They include:

Technical Analysis – You’ll find this in most trading software. It includes chart patterns, moving averages, interactive charting capabilities etc.

Fundamental Analysis – This grants access to fundamental information like analyst ratings and financial statements. It also offers proprietary tools that help investors simplify their due diligence.

Paper Trading – Paper trading is a simulated form of trading. You can trial your trading skills before investing in real capital.

Programmatic Trading – This is an advanced automated software. The software solutions might also come with backtesting functionality. This allows investors to see how trading strategies would work modelled off of historical data.

What software will you need for your target audience? You can hone in and develop an app with Paper Trading software. Alternatively, you could create a large commercial trading platform. One that incorporates Programmatic Trading, Technical and Fundamental Analysis.

With these in mind, let’s briefly turn our attention to the size of the investment platforms you might want to create. This will help define the scope of your project.

Commercial Trading apps are amongst the most popular on App Store markets. They include the likes of Robinhood, Bitcoin, TDAmeritrade and Interactive Brokers. Some trading apps, M1 Finance, for example, offer investment solutions instead of day trading. This means you cannot trade the same stock more than once a day.

One of the biggest attractions of these apps is commission-free trading or low-cost trading. This is combined with varied and advanced software. They're user-friendly with lots to offer investors. Above all, they've attracted millions of people to the potential of fintech.

Proprietary Trading refers to the commercial banks and firms that can invest capital they already own. They have the competitive advantage of market knowledge and strategies, complex investment vehicles and derivatives. They stockpile and provide liquidities on their securities.

WHAT ARE SOME OF THE KEY FEATURES A TRADING & INVESTMENT PLATFORM SHOULD HAVE?

We’ve identified potential software, audience and scope. These are the foundations for your market research and app development. Nevertheless, you’ll find consistent features across all of the popular commercial trading apps. You want a user-friendly and functional platform. Many apps offer basic and premium features. We’ll run through some of them now.

A user’s dashboard should be their one-stop-shop. It provides sortable and essential data. With real-time stock quotes, updates and charts, users can track their goals and progress. Rolling updates inform users of the latest price patterns, accurate data and efficient strategies.

Market news and updates are crucial for investors and their decision making. It can be customisable and relatable to their portfolio and investments.

A calendar is a must-have feature. Users can stay on top of future and past investment, and monitor alerts and notifications.

You might want to consider training modules. Apps like Robinhood come with training options for novices to help them get started.

Watch lists are one of the best ways for users to monitor potential trading and investments. They display information like percentages changes, bid price and volume.

A stock scanner is a powerful tool that searches for stocks amongst markets. User-selected criteria set the metrics for their investing and trading.

A user profile. With trading history, help features, settings and subscriptions.

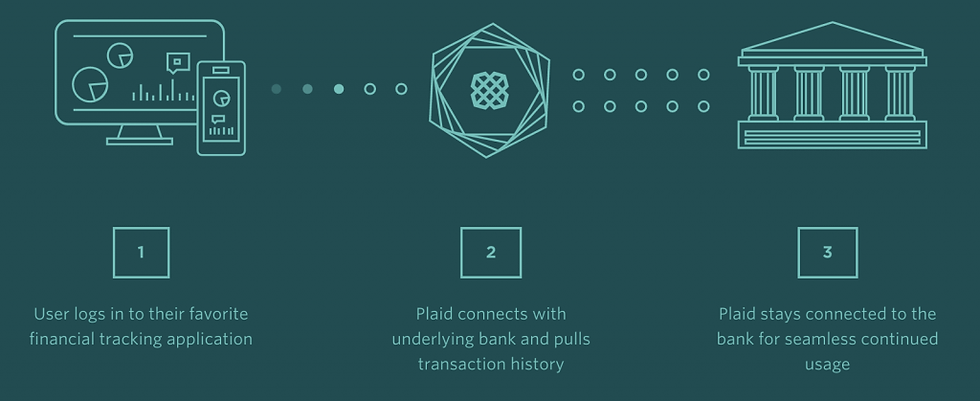

Plaid API that integrates with users’ bank accounts. This has become a key tool to connect traditional banks with fintech capabilities.

These are just a few key features. You’ll also want to consider your home screen design, newsfeeds, notification etc. At this point, we’ve got the ingredients for your app. Now we need a methodology.

HOW DO I CREATE AN INVESTMENT APP?

Building your trading app will take months of planning and a skilled workforce behind you. Here’s a quick rundown of 5 key items you'll need to consider.

1. Assembling Your Team: You’re nothing without a strong team. Consider if you’ll grow a big core team vs how much work you will outsource. You’ll need engineers, legal experts, market researchers and strategists too. We’ve written lots on the importance of teamwork on our InvaBlog posts. Check out our guide on remote hiring for some useful info! Or check out our blog on launching an ICO.

2. Platforms, Mobile Apps and Design: iOS and Android will be your go-to platforms for development. Your platform aggregates relevant stock market data and transactions. Whilst you could create an app working with stock market data through APIs, it’s safer and easier to have a back-end solution with your platform.

From there, you’ll want to consider a mobile-first design; since you’re building a mobile solution. Your app’s UI & UX will need to consider screen space, micro-interactions, chatbots, layout etc. Even if you’re building a desktop or web-based platform, it must be adaptable for a mobile solution. So a mobile-first design is a must for scalability. Prototyping will be a huge asset for discovering potential flaws and bugs.

3. Technical Aspects & Infrastructure: Trading APIs integration is a significant step forward in your app’s automated trading software development. You can find a variety of trading APIs here that offer a variety of data. They can range from historical data to crypto and exchange rates.

4. Prototyping & Testing: It’s vital you thoroughly test and prototype your app and platform before launch. After all, you’re transferring and holding users’ money they can’t afford to lose through faults. Testing processes like the volume of transactions your app can handle a second are fundamental to safety and success.

5. Maintenance: It's months later. You've developed, tested and rolled-out your app. Congratulations! Now you need to oversee its maintenance. This includes eradicating bugs from API updates and expanding your app with new features. A great CRM and team of engineers are essential for keeping your customers happy and your app running smoothly.

ONE LAST THING... HOW MUCH WILL IT COST?

Several factors will determine the cost of developments. Where you develop the app plays a role. Whether it's in North America or Asia for example. The size of your team or company. The cost of the iOS or Android platform. The features on your app. The maintenance.

If you're working on a small budget with third-party development, you can aim from $70k-$200k. If you're ambitious and have the funds, you could look between $450k to millions. There's no simple set figure. If you don't know where to get started, Invatechs is here to help. More on that at the end.

WHAT ARE SOME OF THE MOST POPULAR APPS ON THE MARKETS?

Robinhood has a user-friendly and intuitive interface. At only 7 years old, it's one of the most popular fintech apps. It offers free commission trading and cryptocurrency trading. This went on to influence other trading apps to reduce and cancel trading fees.

TDAmeritrade is a much older and established trading platform. They offer a wide scope of platforms. They're compatible on mobile, smartwatches and desktops. It comes with great customer services and a thinkorswim app for skilled traders.

Acorns focus on nurturing consistent investments and long-term savings. It delivers portfolio management and cashback offers that automatically get reinvested. It's perfect for skilled and novice investors alike. These are some great trading apps to inspire your future development.

WRAPPING UP WITH FAQs

How many months will it take? Between 6 - 9 months minimum.

Are trading algorithms profitable? Absolutely! It won't happen overnight, but with strategy and time, it can pay off.

Where's a great place to find stock exchange data? Check out Alpha Vantage and Yahoo Finance.

What regulatory compliance do I need to be familiar with? Know Your Customer (KYC), Customer Identification Programs (CIP) and Anti-Money Laundering (AML). These are crucial for your app.

Where can I find help to get started? Invatechs are your first call for expert advice and development.

IN CONCLUSION - THE NEXT STEPS FORWARD

We've touched on what you need to consider for you to create a successful trading app. These have included some key items, software and platforms that are crucial for the process. We hope you're excited by this expanding popular market. It's time to strike while the iron is hot and join the likes of Robinhood.

We recognise that getting started can be a huge and scary endeavour. That's where Invatechs come in. We have deep expertise in the fintech domain and offer the very best app development. We've created cryptocurrency saving applications and microcredit platforms. We offer practical solutions and development that is data-driven. We'll ensure your app is the very best with maintenance and advice services.

By collaborating with you, we'll take your fintech project from conception to completion. What does your visionary trading app look like? You can reach a generation of traders old and new by contacting Invatechs today.

Comments